Debt collection is an ever growing issue nowadays. Lending responsibly is one thing, but trying to minimise accounts receivable (AR) is a completely different kettle of fish altogether.

In fact, a study conducted by Euler Hermes revealed that one out of every four companies take 88 days or longer to settle outstanding balances, while 9% take over 120 days.

One of the key methods of effectively driving the average days sales outstanding (DSO) down starts with the messaging in connection with accounts receivable. By using nudges to optimise the way you communicate with your customers, you can free up cash flow, streamline processes and maintain relationships.

Key takeaways:

- Nudges are scientifically proven to effectively guide the behaviours of customers and can integrate into common digital interfaces such as accounts receivable emails, SMS, push notifications, social media posts, apps and gamification.

- Incentives like payment discounts, waiving fees and payment plans are great ways of nudging a customer into settling their accounts receivable.

- Using biases in your communications can play a vital role in getting positive responses and generating better results in debt collection processes.

- Designing a nudge requires you to define the goals, understand the decision process, consider what biases work best and regularly test the effectiveness of the communications.

What are Nudges?

Nudging is a term used to describe the action of guiding people’s behaviours by the use of user-interface and design elements in digital environments. Scientific studies show that on a cost-adjusted basis, the effectiveness of nudges is often greater than that of traditional approaches.

Nudges come in all shapes and sizes, playing an integral role in optimising accounts receivable messaging.

Today, nudges are mostly digital and can be used in many digital environments, such as email, SMS, push notifications, social media posts, mobile apps and gamification. All these digital interfaces are critical in the decision-making process and are used as a creative means to present nudges. For example, effective debt collection emails can include an early payment discount with a deadline as an incentive to high-risk customers.

Introduce a Conflict Resolution

Humans are self-orientated beings, always thinking about what’s in it for them.

As mentioned earlier, incentives are an efficient means of lowering DSO, as they give your accounts receivable messaging weight. They act as conflict resolution, keeping customers engaged and positive.

Early payment discounts, waiving fees or agreeing to payment plans are prime examples of how you can keep the peace while maximising cash flow and settling accounts receivables.

In the banking sector, they often use a carrot and stick method, whereby customers receive financial incentives like the example above (i.e. the carrot), before reverting to warnings, administrative penalties, bad credit reports and legal actions (i.e. the stick) – which often causes conflict.

McKinsey showcases the potential to appify the nudge used by the healthcare field. Instead of focusing on whether customers have paid their outstanding debts, the healthcare field asks them whether they’ve achieved a challenging goal.

63% of the healthcare field surveyed said they used small rewards as incentives to promote their diet and exercise schemes. Health apps have formalised incentives, making it easier for users to track their progress and align it with a system of rewards. The Nike Run Club app uses badges and congratulatory messages from celebrities to keep runners motivated. This same idea can be used within the debt collection process as a part of the carrot process, giving medium-risk customers the prod they need to make regular payments.

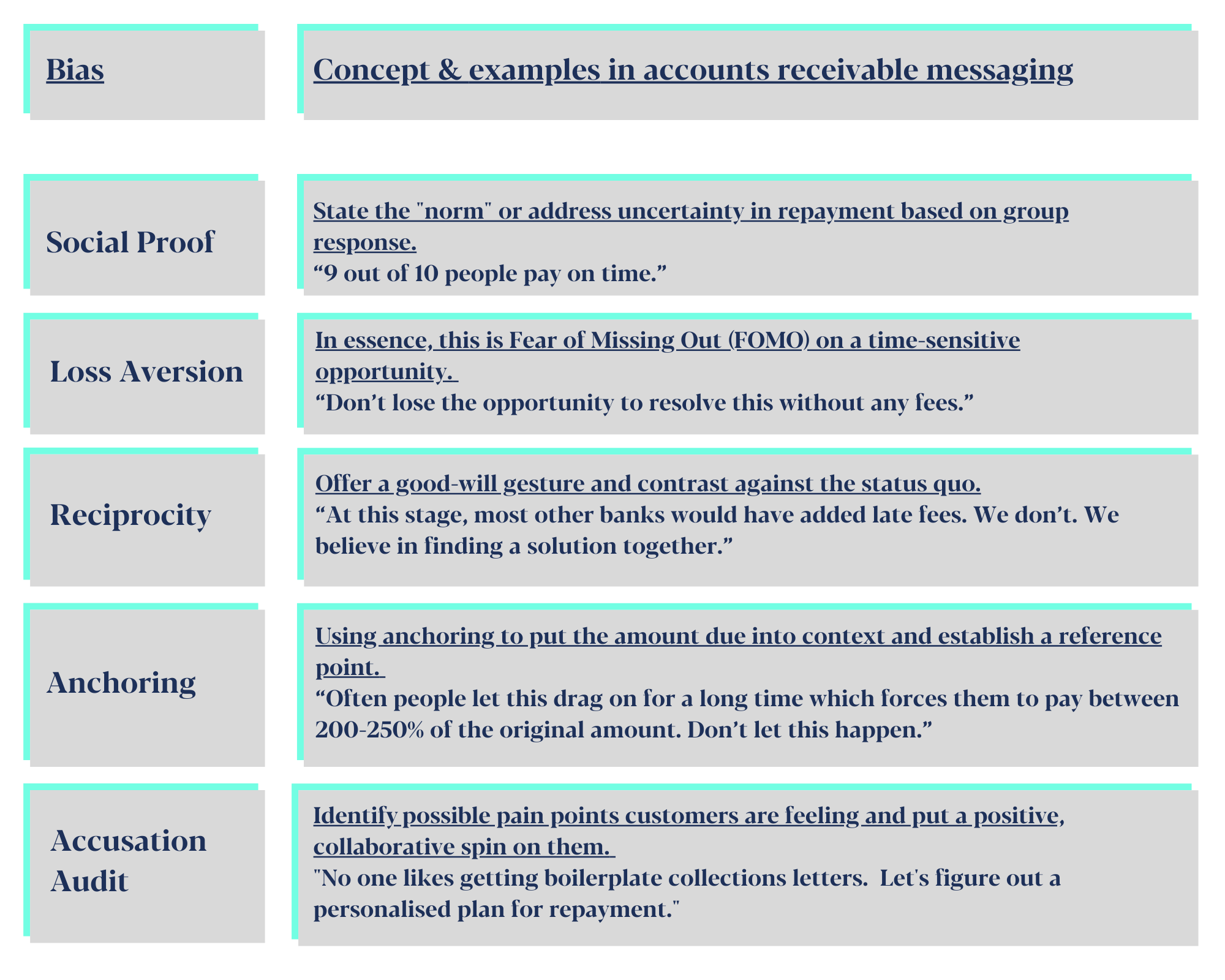

Using Biases in Your Communications

A lot of the issues surrounding accounts receivables lies in the way businesses communicate with their customers.

Debt collection can learn a lot from the marketing industry by looking at the way they address specific audiences to tap into their behavioural habits. Whether you want to write the best debt collection emails or create effective debt collection SMSs, you must view the collection process as a communication and not the imposition of terms. This can be implemented by constructively using certain biases as the basis for nudges.

You’ll find some examples of these biases below:

The digital channel you use is important, too. For example, relying on email communications to settle accounts receivable from the older, less tech-savvy generation, probably won’t work – regardless of how compelling the bias of your nudge is.

Similarly, direct mail to 18-25-year-olds can easily miss the mark because it doesn’t fit in with their busy lifestyle. Whereas there’s a 98% chance that an accounts receivable text message will be read – according to The State of SMS white paper by Textlocal. Using text messaging as a platform, along with the right nudge can be read and actioned on the go. It’s about using the right digital environment at the right time.

Designing a nudge for your accounts receivable messaging

To create a successful nudge that speeds up the debt collection process within your accounts receivable emails, SMS and other digital interfaces, you must ask yourself the following questions.

Defining the goals of a nudge:

- What is the use scenario?

- What are the overall company goals?

- What specific goals are you looking to achieve?

- What are the ethical implications of nudging people into making a certain decision?

Understanding the decision process:

- What are the users’ goals?

- What are the users’ decision-making processes?

- What heuristics might influence users’ choices?

Design the nudge:

- What types of nudges could counter the influence of biases?

- What types of nudges could increase the influence of biases?

- What nudges could inadvertently influence users’ choices?

- How can the design of the user interface be modified to include the preferred nudges?

- How can we analyse users’ behaviour to adapt the choice environment dynamically?

Test the nudge:

- How effective are the various nudges?

- Does the effectiveness differ across users?

- Do the nudges fit the context and the goals?

- Do we have a thorough understanding of the users’ decision-making process?

Final Thoughts

At the end of the day, the best way to start optimising your accounts receivable messaging is by understanding your current state.

To do this, you must conduct a gap analysis to identify any potential areas which aren’t generating enough positive responses. For instance, if an email in your current debt collection cycle is receiving poor open rates and/or is getting little to no replies, you need to address the messaging.

Once you establish the bottleneck in the debt collection process, you can improve the tone of your messaging in the problem area by using biases as a basis for nudges.

Your gap analysis should also investigate your company’s performance compared to competitors to enable you to identify best practices, behaviours and trends.

We'd love to show you what we've learned and how our solution can help you. We combine the latest findings in behavioural science and artificial intelligence with cutting-edge automation methods to streamline the debt collection process while optimising accounts receivable messaging.

To learn more, you can download a guide to collections outreach with email templates you can easily use!