“Software is capable of delivering extensive gains before you need to even consider debt collection agents!”

Debt collection isn’t a media darling, and you rightfully may know very little about it. What’s probable is that you consider it sleazy or associate it with aggressive tactics. Regardless of what experience you may have had with debt collection, you probably know even less about the players in this segment. They have in years past remained fairly under the radar, and one can deduct why they don’t like to step out into the limelight much. You may even know some names in the industry, having seen something here and there, but you’d be hard pressed to distinguish one from the other.

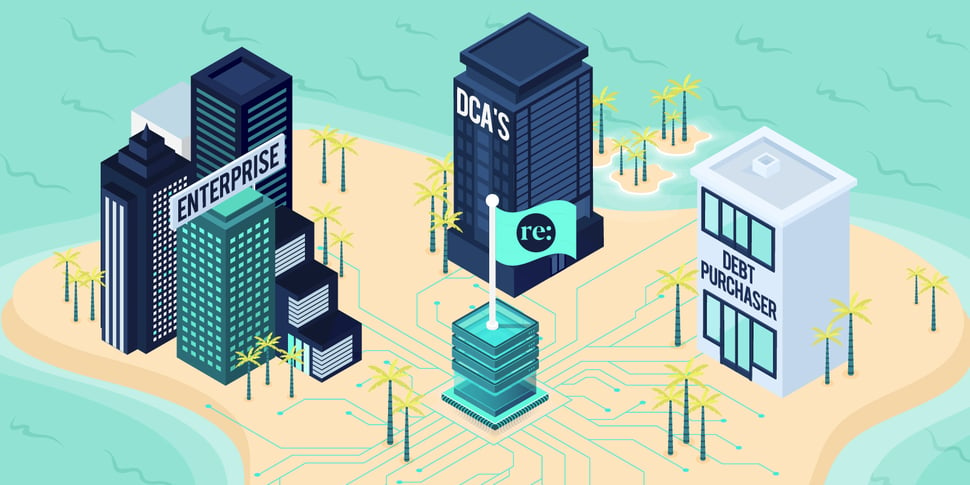

What is clear is that their business model hasn’t changed much in the last twenty years. Further, in large enterprises, collections have been outsourced to subsidiaries or even completely to external third parties. Out of sight and out of mind. Large enterprises need to start addressing this as they no longer can afford to give away all the potential value generated via effective collection processes. Further, they can’t give away the customer relationship which is completely lost when outsourcing. Additionally, extensive data and insight are generated in the process, with the ability to flow back directly into the organisation and optimise core business processes.

What’s the Status Quo at DCAs?

When discussing a brand in the debt collections space, you will most likely speak of a debt collections agency (“DCA” for short). These are service providers, and their core business model is fairly simple. They either buy unpaid bills from their partners or act as a third-party service, working on behalf of their partners. Whichever structure they choose, their revenues boil down to collections fees. For the service they provide, they generally take a fee from those where they source their bills and on top of this fee, charge their own “collections fee” plus interest when recovering the unpaid monies. Obviously, the total cost of collection is passed on to the end customer, and is the reason that an unpaid bill of €100 can easily swell to €150 or even €170. The level of acceptable fees varies by geography and certain countries have already taken action to minimise the abusive fee structures. Additional regulation is also quickly making its way through various government avenues.

As the industry has matured, so too have the business practices. The largest players not only service debt collection but have grown into financial players themselves. Using their own or third-party capital, they purchase “portfolios” of debt which they thereafter service themselves, keeping whatever they can recover. These portfolios are, for example, non-performing loans (NPLs) from banks and financial institutions or pooled portfolios in certain industries where individual claims are tiny, but number in the millions. Due to the difficulty of recovery, billion Euro portfolios are at times purchased for a fraction of their face value. Consequently, due to the sheer size of these portfolios, you need an army of employees to do the necessary work to collect on them. The larger players in the segment can easily have ten to twenty thousand employees, and they work on a global scale.

Competition Has Heated Up in Debt Collection

Within the past ten years, the industry has done very little to digitalise their processes. Although the technology has existed for years, the majority of collections processes involve sending letters, fielding phone calls and maybe here and there interacting via email. With profit margins as high as 40% or more, there really hasn’t been much need to adapt. Honestly, were I in the shoes of senior management at many of these companies, I too would focus on maximising revenues. Being publicly listed or majority owned by private equity firms, this is exactly what is expected of management. Their businesses have not only grown because the number of claims has increased, a decade or more of cheap capital in the markets has fuelled expansion internationally via M&A. Unfortunately, the success of a few incumbents has led to an explosion of players in the business and competition has started eating into profits. You now have thousands of players in the segment, spanning from firms with thousands of employees down to mom-and-pop DCA’s. With everyone chasing the same revenues, players in the segment have started eating into one another’s profits. Increased availability of cheap capital and the resulting increased competition on price have made the purchasing of portfolios ever more cost prohibitive, minimising any ability to squeeze out margins. And lastly, the politicians have woken up to the underlying practices, and regardless of how strong the industry’s lobbies are, they are contending with ever more regulations.

Software as a Solution

The answer to all of this is software. As Marc Andreessen wrote, “software is eating the world!” So too will software eat into collections. An industry so dependent on headcount cannot continue to grow. An industry with profit margins potentially disappearing overnight due to regulation cannot continue business as usual. An industry which doesn’t take the end customer into account and work to make the process as smooth and customer friendly as possible can’t expect to thrive. The answer is technology and very specifically, powerful platforms which address the whole credit lifecycle. Collections should no longer be a cost centre without any direct impact on the core business. The amount of insight and data generated via collections processes and throughout the whole credit lifecycle can directly affect business strategies in any credit related interaction with customers. Data can flow back up through the organisation, and lending strategies, for example, can adapt in real-time based upon the insights generated using collections software.

Software is Complimentary

Large enterprises can take control of their collections again. The easiest way is by implementing software in-house. This allows the enterprise to not only reap all of the rewards that executing collections yourself allows for, but it means control. When you implement software to drive your collections, you own your strategies. You determine exactly how the strategies are executed. You pick the content that your customers receive. You offer the options for payment that your customers are free to choose from. Ultimately, you recover as much cash as possible out of these processes before giving it away to partners. In the past, the cost of collections in-house was simply too prohibitive as it involved extensive headcount and manual processes. Those days are long gone and so too should be the process of outsourcing collections. After you implement software to recover as much value as possible, you can still work with DCAs. They will remain a relevant part of the process once it comes to legal collections and the hardest cases. Nevertheless, you end up owning your own funnel by implementing collections software, and when the funnel is yours, you can maximise what you recover in-house and minimise what goes out the door after passing through the funnel.

The Future of Collections is Software

It is inevitable that the DCAs will implement ever more software. As mentioned above, their business will start feeling the pressure of employee costs, extensive competition and lack of access to cheap capital. Further, those operating at an international scale have fragmented IT backbones without any of the benefits of using a unified platform. Extensive regulatory changes which need to be adapted each and every time at country level when something changes can make IT at DCA's a nightmare. The same goes for maintenance, updates and innovation in connection with these IT systems. The current legacy software being used at the DCAs is from companies started in the 90s. These are bloated software packages which have an underlying software concept which isn’t what drives frictionless collections strategies in 2020 and onwards. Finally, once technology and collections head back in-house at large enterprises, there will be an increase in the need to tap into these software systems to create a painless flow from enterprise to DCA. As already mentioned, DCAs aren’t going away any time soon, and when it comes to legal collections, they will remain the best option. If they don’t adapt to the available technology and ongoing shift to software, those who wait will be left behind.

If you’d like to discuss with us how you too can take back control of your collections and leverage software, please reach out or book a demo to see this technology at work.